40+ Fha to conventional refinance calculator

Use our free mortgage calculator to estimate your monthly mortgage payments. Typically an FHA loan is one of the easiest types of mortgage loans to qualify for because it requires a low down payment and you can have less-than-perfect credit.

How To Calculate Mortgage Payment In Microsoft Excel Quora

They allow borrowers to have 3 more front-end debt and 7 more back-end debt.

. What Are Todays Refinance Rates. Some banks and mortgage lenders provide 40-year loan. 580 Credit Score - and only - 35 Down.

For homeowners with FHA loans issued on or after June 3 2013 you must refinance into a conventional loan and have a current loantovalue ratio of 80 or lower. Low Down Payments and Less Strict Credit Score Requirements. The first tab offers an advanced closing cost calculator with detailed and precise calculations while the second tab offers a simplified closing cost calculator which shows a broader range of estimates.

An FHA streamline refinance is a type of rate and term refinance option. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Loans backed by the FHA may be an affordable alternative to a 40-year home loan.

Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. See all Mortgage Learning Center. To qualify your mortgage must be current meaning you should have made the last 6 months of payments on your loan.

If your mortgage rate is above 666 now is probably a good time to refinance. If you currently have one or more VA loans and looking to refinance one of them use this calculator to see if you will need a down payment or if your sufficient equity. Loan-to-value ratio LTV is.

Unless you put 20 percent down or refinance with at least 20 percent in home equity your conventional lender will likely require PMI. Your FHA mortgage should also be at least 210 days active before you refinance. You also dont have to refinance into a 30.

FHA loans also require 175 upfront premiums. 580 Maximum debt-to-income ratio. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D.

35 Minimum credit score. Or want to refinance your existing conventional or FHA mortgage the FHA loan program will let you purchase a home with a low down payment and flexible guidelines. It is probably worth considering a mortgage refinance if you can reduce your current interest rate by at least 05.

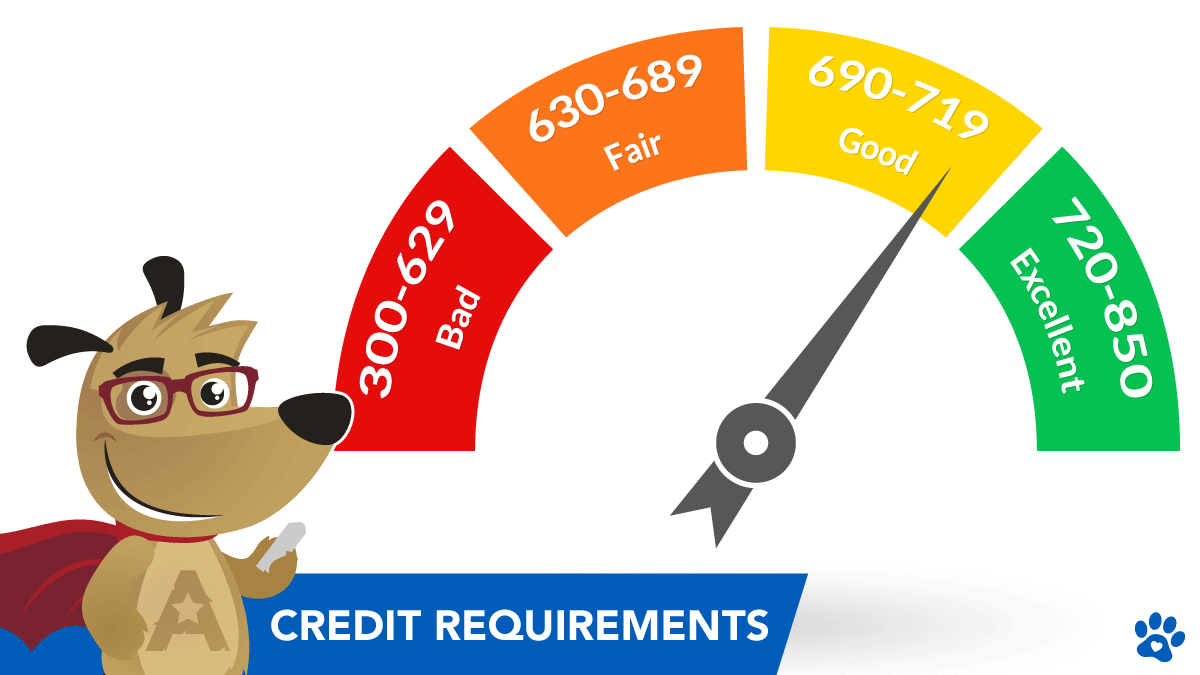

Minimum down payment. Assuming you have a 20 down payment 80000 your total mortgage on a 400000 home would be 320000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1437 monthly payment. Earn A Higher Credit Score in 8 Steps.

PMI will typically cost between 05 and 25 of your loan value annually. Account for interest rates and break down payments in an easy to use amortization schedule. Todays national mortgage rate trends.

FHA loans have low interest rates. Conventional Loan 3 Down Available Via Fannie Mae Freddie Mac April 8 2015 3 Down payment mortgages for first-time home buyers April 21 2022 Do bi-weekly mortgage programs pay your mortgage. Most FHA insured lenders however set their own limits higher to include a minimum score of 600 - 620 since cash-out refinancing is more carefully approved than even a home purchase.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Down Payment Assistance in 2022. If you cant afford a 20 down payment on your home and apply for a conventional loan youll have to have private mortgage insurance PMI to cover the costs or just plain mortgage insurance for a government loan FHA loans or VA loans for example.

Depending on the loan amount and interest rate. In the US the Federal government created several programs or government sponsored. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week.

Mortgage Insurance and Refinance Options. FHA loans have more lax debt-to-income controls than conventional loans. The reason that FHA loans can be offered to riskier clients is the required upfront payment of mortgage insurance premiums.

Select the Funding Fee Select fee 000 050 100 125 140 165 230 360. Interest Rates and Payoff Dates. Mortgage loan basics Basic concepts and legal regulation.

Qualifying for a conventional mortgage requires a higher credit score solid income and a down. The first portion of the mortgage refinance calculator requires input of current numbers like monthly payment loan interest rate and remaining balance and term. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

The less you. According to FHA guidelines applicants must have a minimum credit score of 580 to qualify for an FHA cash-out refinance. Choose Your Mortgage Options Carefully.

Conventional PMI vs FHA mortgage insurance. FHA loans are great for first-time buyers or people without sterling credit or much money. Benefits of FHA Loans.

You might be able to refinance to a 40-year mortgage depending on what your lender offers. Conventional mortgage loans do not require government mortgage insurance premiums MIP but they do require private mortgage insurance or PMI. A 30-year conventional loan.

For FHA loans down payment of 35 percent is required for maximum financing. A guide to better understanding closing costs is. This only allows you to obtain a lower rate change your term or both.

Streamline Refinance Cash-out Refinance Simple Refinance Rehabilitation Loan. The current average mortgage rate for a 30-year fixed-rate loan is 566 according to Freddie Mac. The third tab shows current Boydton mortgage rates to help you estimate payments and find a local lender.

See the monthly payments total interest and amortization for a 300000 mortgage over 15 or 30 years or use our free calculator to see how much youll pay. On Tuesday September 06 2022 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year fixed mortgage refinance. Unlike FHA loans conventional loans are not insured by the government.

Fha Loan Pros And Cons Fha Loans Home Loans Buying First Home

Credit Requirements For A Reverse Mortgage Loan

1 Lakewood Mortgage Broker Nathan Mortgage

Colorado Mortgage Loan Officer Get Preapproved Today

1 Mortgage Refinance Company Lakewood Co Nathan Mortgage

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

Fha Loan Complete Guide On Fha Loan With Its Working And Types

Fico Myths

1 Mortgage Refinance Company Lakewood Co Nathan Mortgage

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2 Fha Loans Conventional Loan Mortgage Loan Originator

Manufactured Home Loans Santiago Financial Inc

Webinars Today Training Automation Broker Tools Write Up On Mlo Purchase Focus

1 Mortgage Refinance Company Lakewood Co Nathan Mortgage

![]()

1 Mortgage Refinance Company Lakewood Co Nathan Mortgage

5 Common Home Contingencies When House Hunting

2022 Max Fha Loan In Solana Beach San Diego California